Connect Mercado Pago as a payment system

You can add a payment button to chatbots and landing pages to accept online payments from users with your Mercado Pago account. To integrate Mercado Pago with SendPulse, you'll need to create and activate a Mercado Pago account, copy your token, and have it authorized by SendPulse.

Create a Mercado Pago account

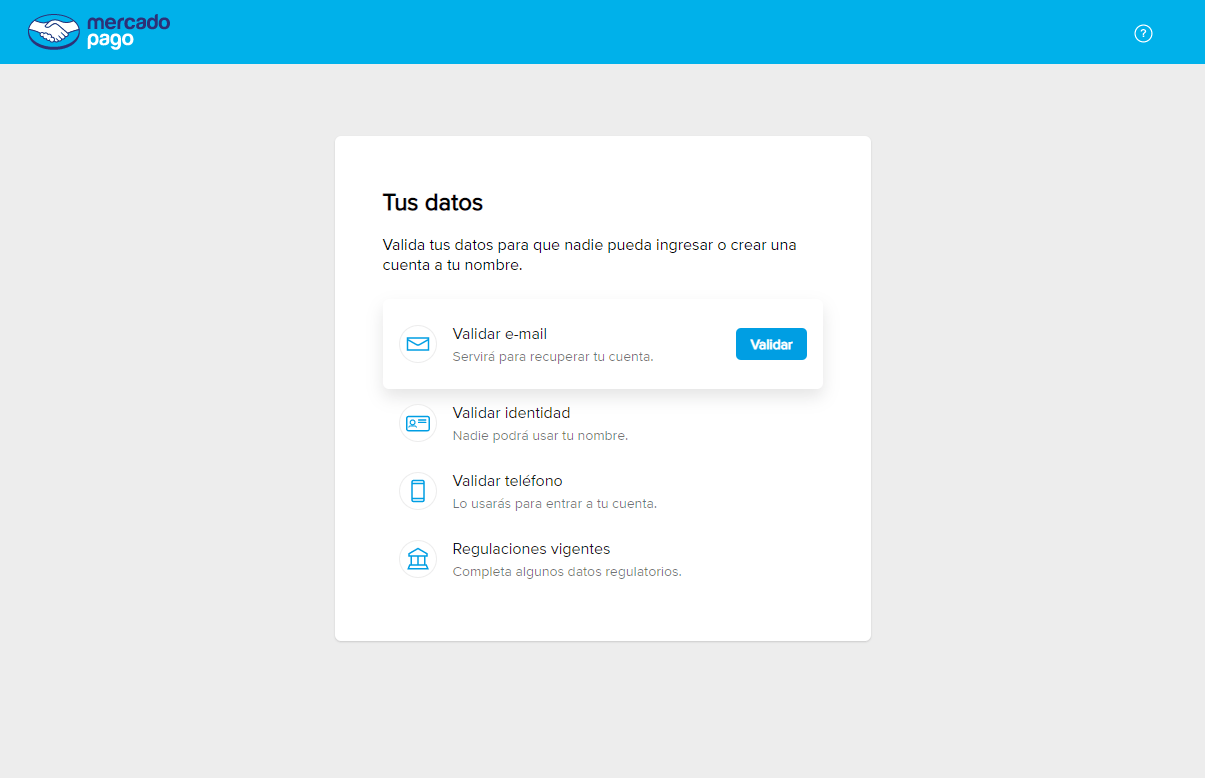

Log in to your personal account, or register a new account with Mercado Pago. When registering, fill out and validate your contact information and your identity.

For more details on how to register with Mercado Pago, create an account, and provide all the necessary documents, please refer to Mercado Pago’s documentation: Getting Started.

Copy the access token from Mercado Pago

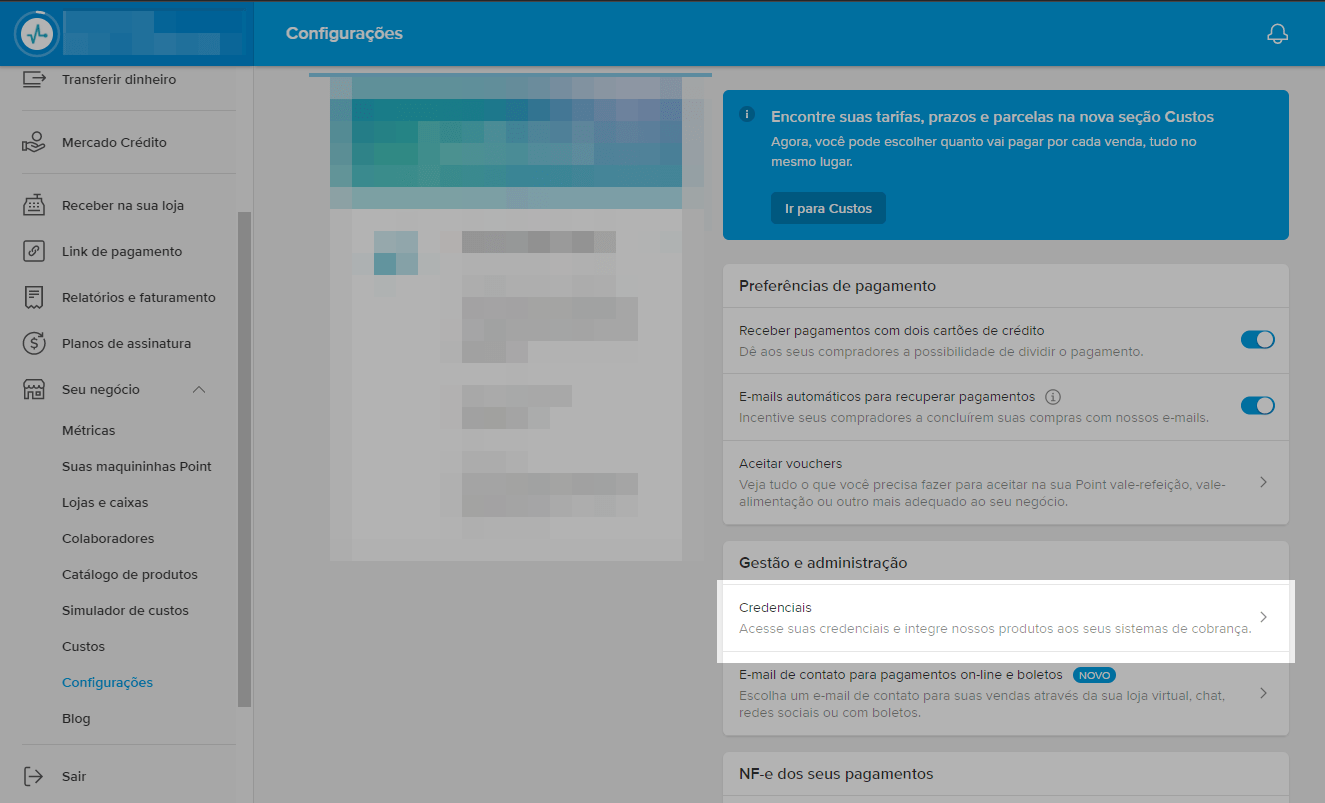

After creating an account, go to Your Business > Settings > Management and Administration > Credentials.

In Portuguese, it will be Seu negócio > Configurações > Gestão e Administração > Credenciais. Read more about these settings in Mercado Pago’s article: Credentials.

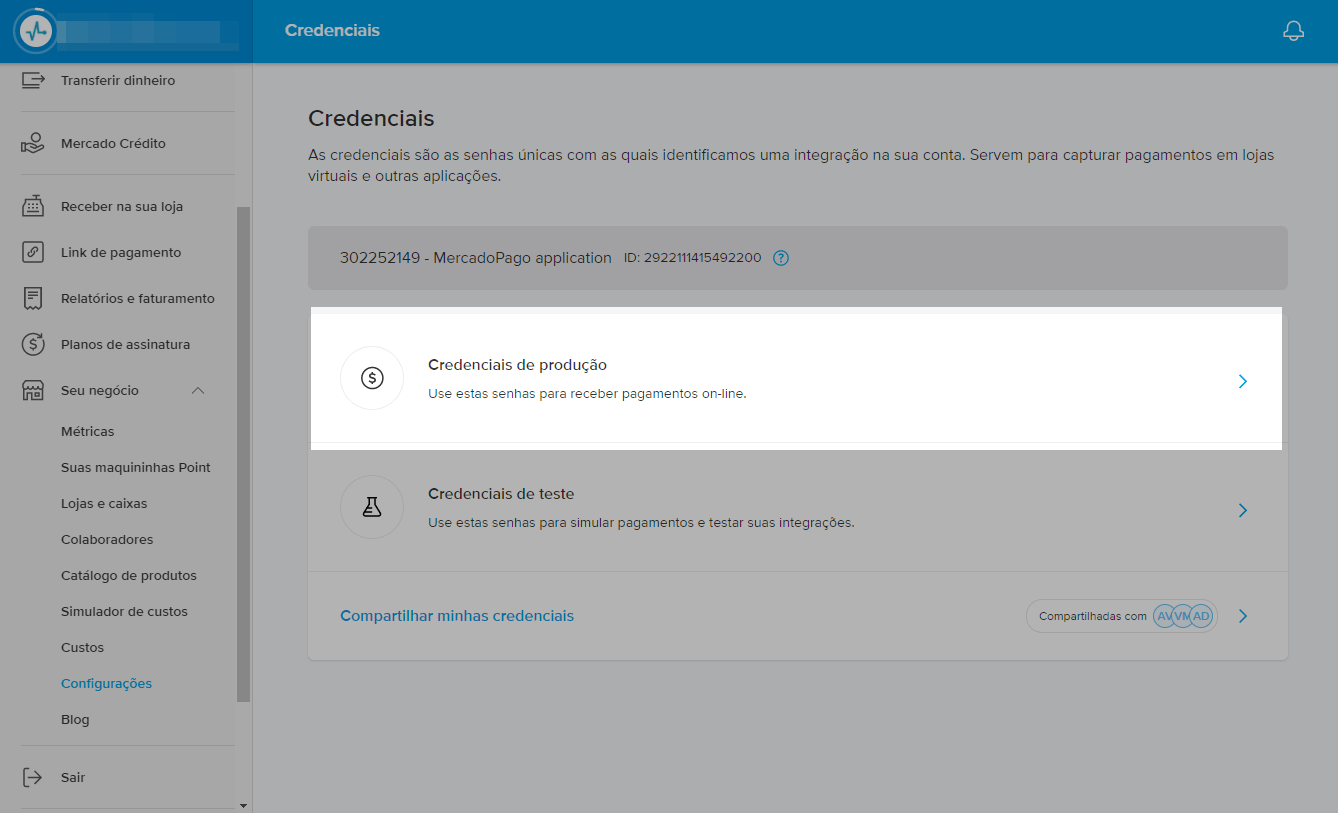

Choose Production credentials.

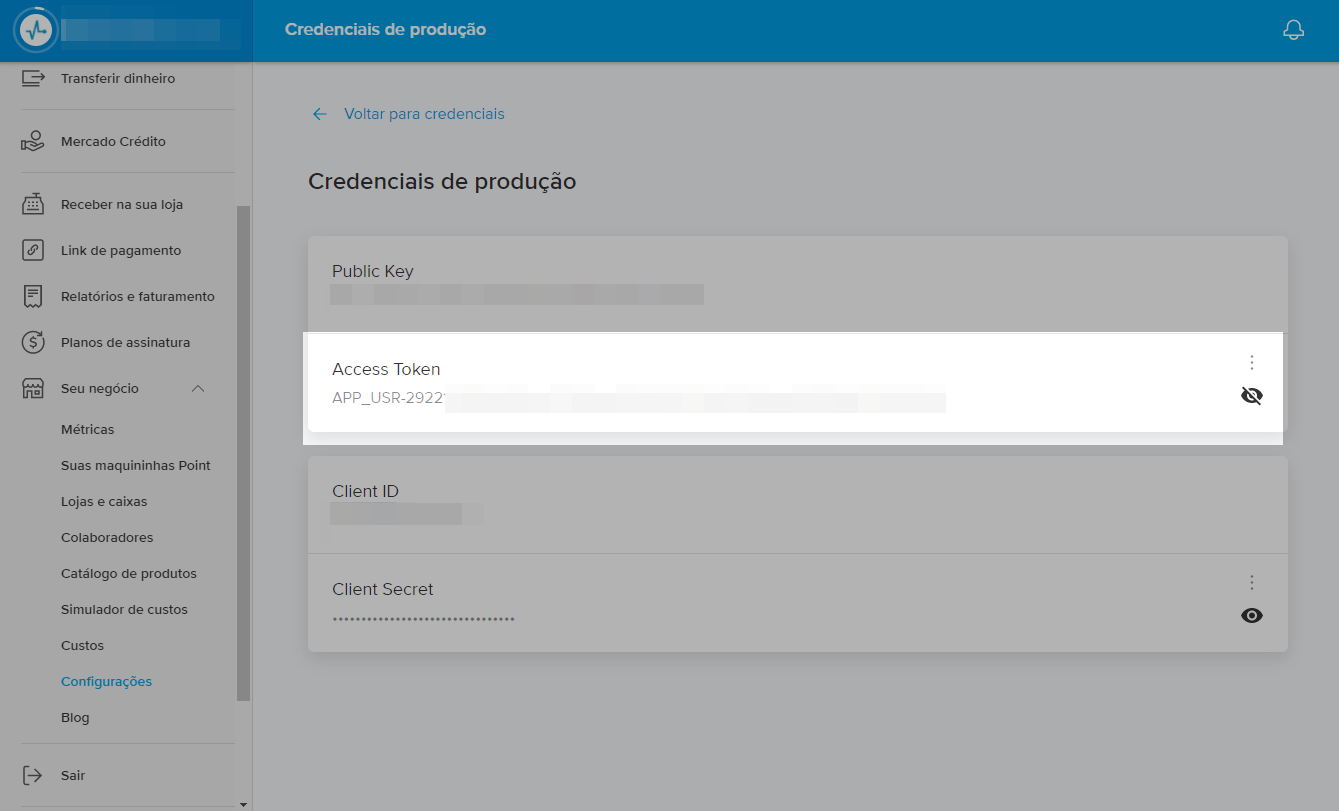

Copy the value from the Access token field.

Connect Mercado Pago to SendPulse

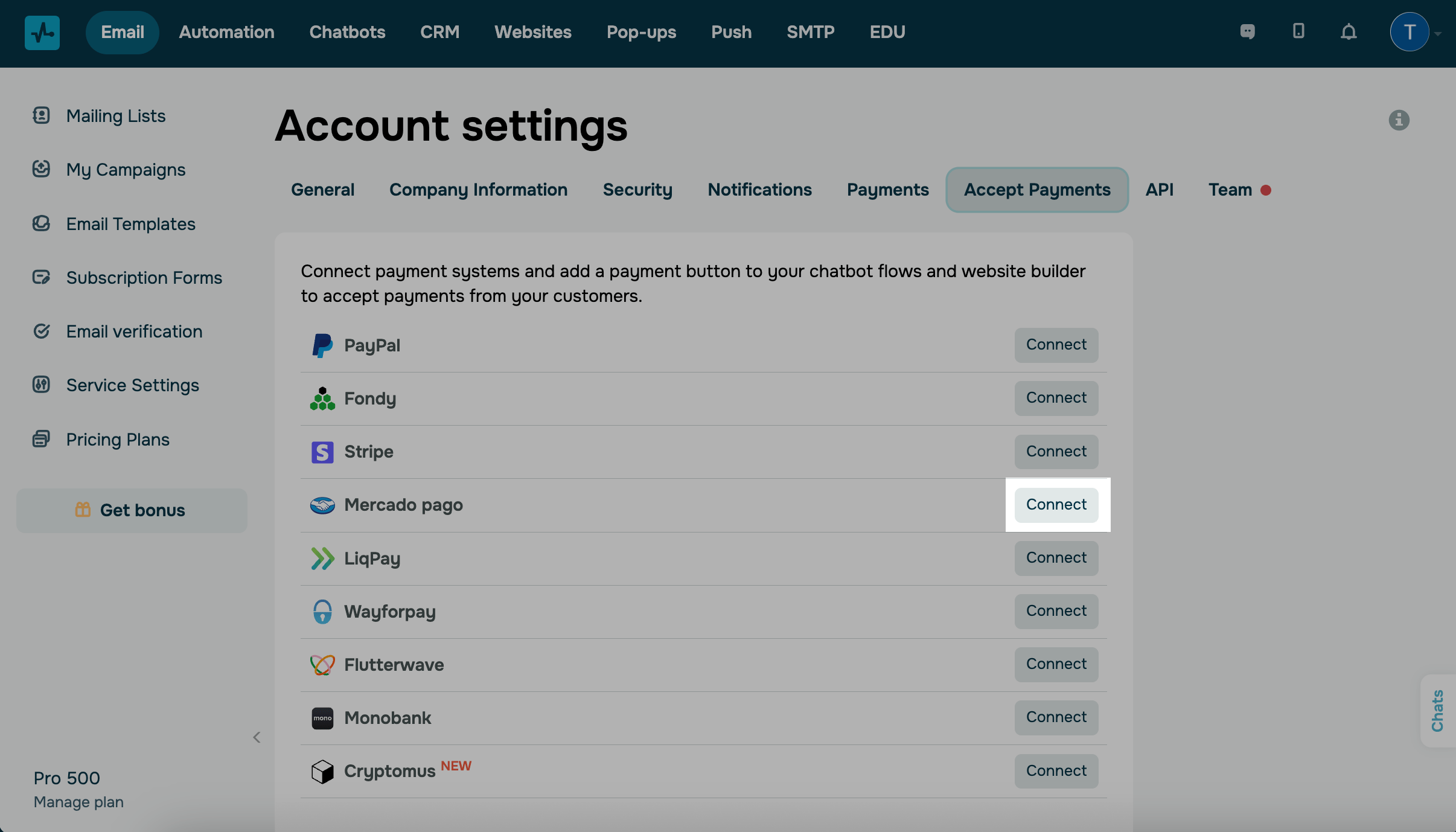

Log in to your SendPulse account, and go to Account Settings under the Payment Acceptance tab.

Next to Mercado Pago, click Connect.

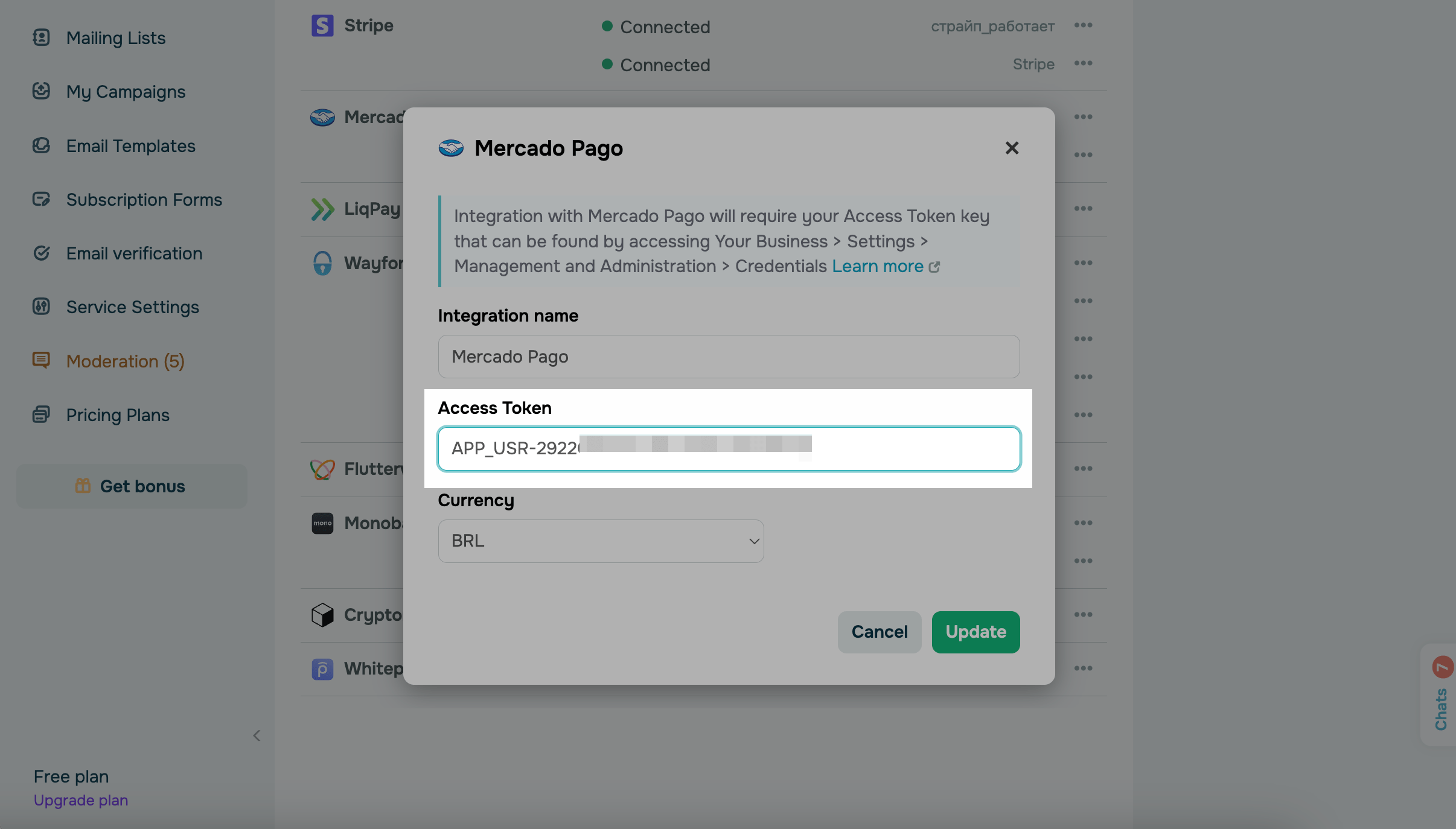

Enter the access token in the corresponding field.

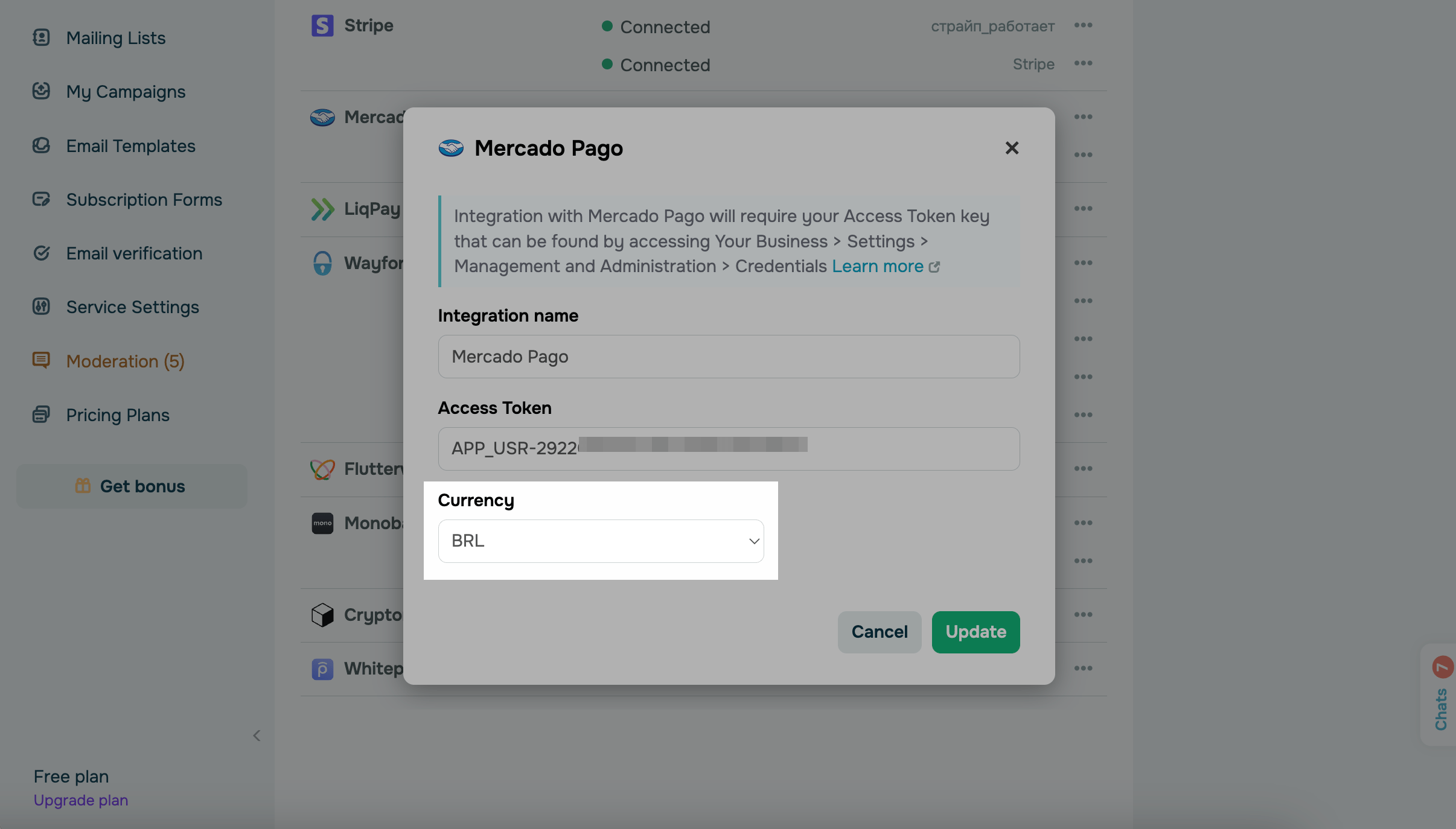

Select the payment currency acceptable for you.

Click Save.

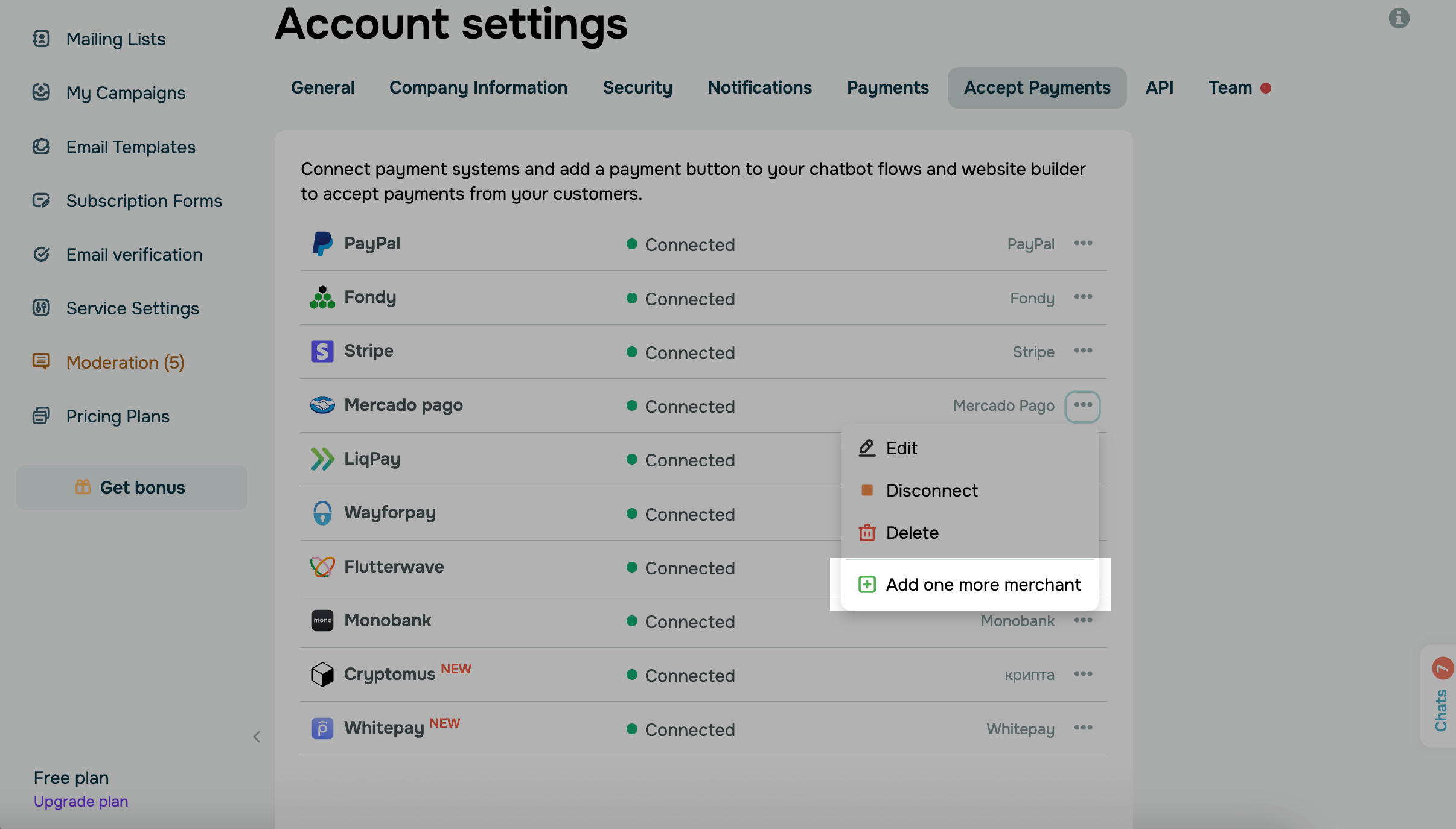

If the values are correct, you will receive a notification, and your connection status will change to Connected.

To connect addition merchant of the same payment system, click the three dots icon next to a payment system, and select Add one more merchant. Follow the same procedure you used when adding a merchant.

Enter a name for your additional merchant so that you can identify it. This name will only be displayed in your account — customers will not see it.

You can now select this payment option when adding buttons in SendPulse tools.

You can view the payment history in the same tab. Mark the list of successful transactions or payment errors in order to respond to them quickly.

Last Updated: 21.05.2024

or