How to transfer RST data to Fondy

An RST is a crucial tool for online businesses that offers a clear mechanism for transferring purchase data to the tax service. It is mandatory in many countries, as it helps control the cash flow, prevent fraud, and ensure the accuracy of companies’ financial statements.

In this article, we will talk about how to automatically transfer RST data to Fondy when accepting payments on a SendPulse-based website.

What is an RST?

RST (Registrar of Settlement Transactions) is a technology created for registration and storage of information about monetary transactions when selling products or services. It simplifies the process of calculating taxes and reporting.

Setting up an RST allows businesses to track their sales turnover and analyze their business performance.

How does this integration work?

To use Fondy as a payment method, it must be connected in your account settings.

Read more: How to integrate SendPulse with Fondy.

If you have added Fondy as a payment method to your website, you can transfer your RST data for each product sold. This way, the fiscalization (transferring data to the tax service) of payments made via your website will occur automatically.

Only successful payments (the ones with the "Success" status) are subject to fiscalization.

Your buyers will receive a receipt by email.

You can find a receipt example in the Fondy documentation.

At the end of each day, the RST automatically generates a report and closes the shift. In the future, you will be able to obtain all reports that confirm fiscalization and are necessary for accounting through the merchant portal or software RST.

How to link an RST to Fondy

Register an RST with your tax authorities. To register, you must submit a form in person at the tax office or through your taxpayer's electronic account.

Get an electronic signature — you can do this on the Accredited Key Certification Center’s website or through another relevant certification center (for example, your bank).

Log in to your Fondy account, or create a Fondy merchant account if you don't have one.

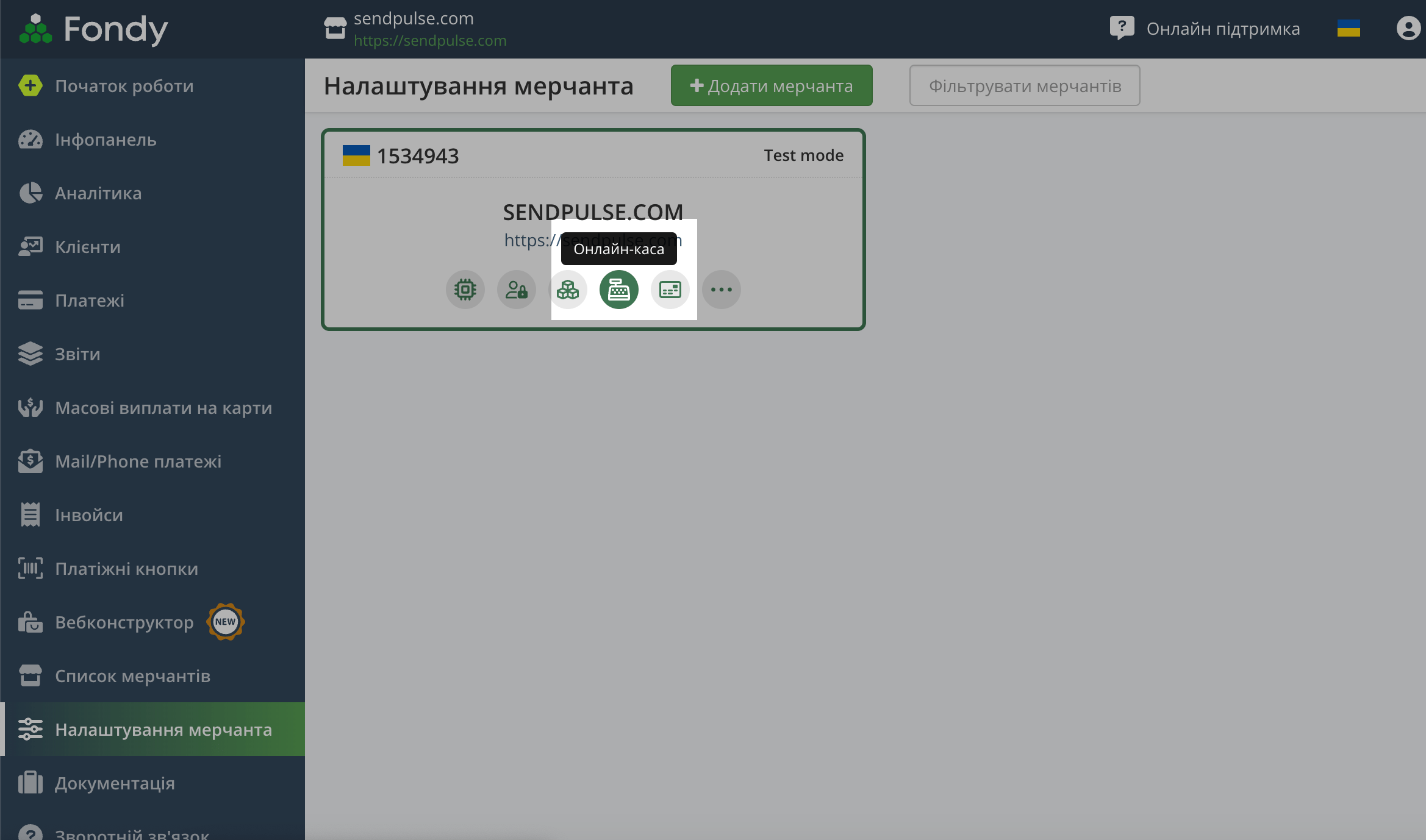

Go to the Merchant settings section, and select Online cash register.

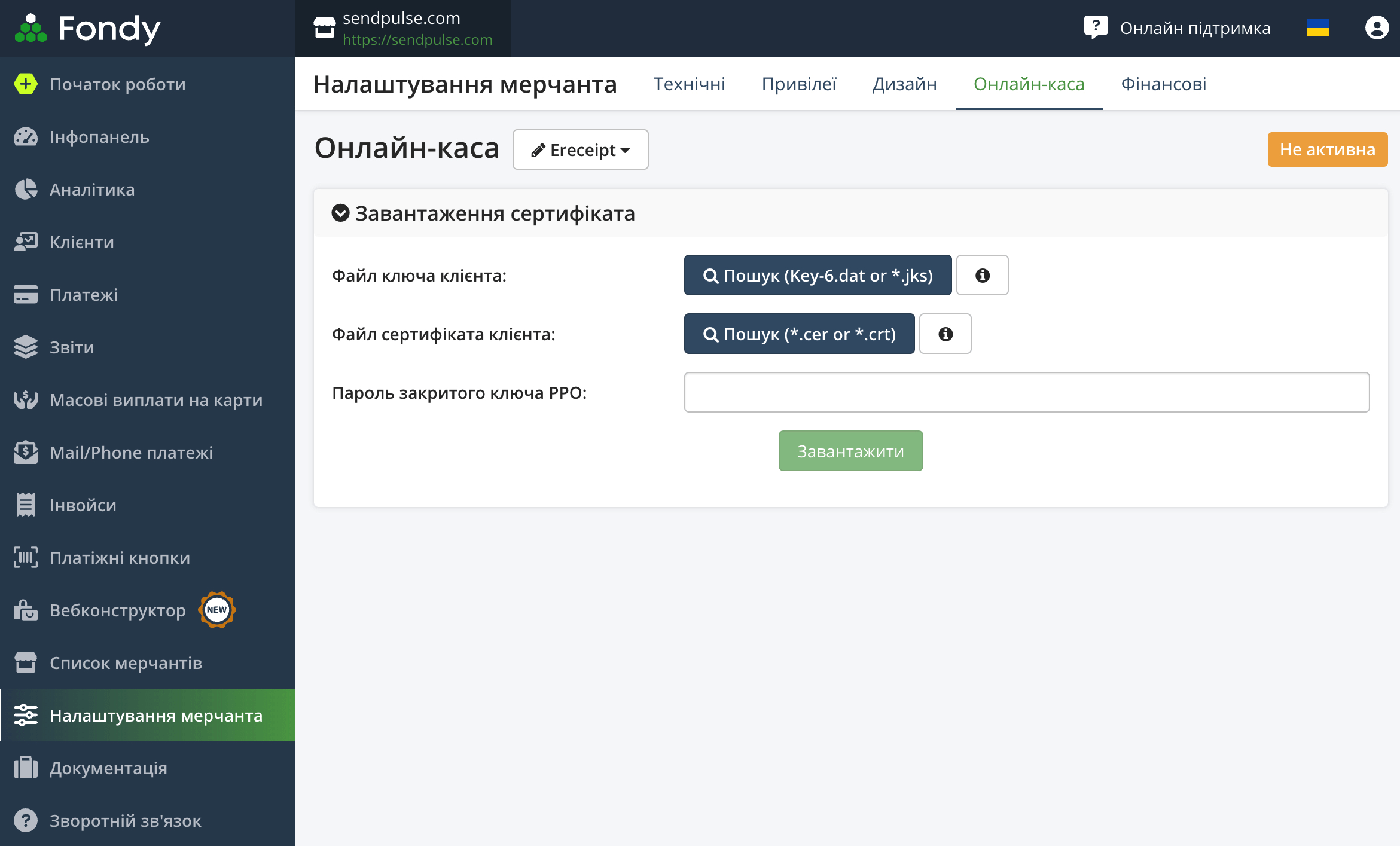

Upload your key files and RST certificate received from tax authorities.

Select a retail outlet and cash register from the list of available ones.

Your RST will be activated instantly, and Fondy will automatically transmit your sales and payment data to tax authorities and send receipts to buyers.

Last Updated: 19.03.2024

or