Economic value added (EVA) is a measure that reveals the financial performance of a business based on its residual income. It aims to define the value a company generates with the help of the invested funds and improve the generated returns for shareholders.

Why is economic value added important?

Entrepreneurs looking for a measure to figure out the performance of their business often consider their economic value added which is rapidly becoming a preferred indicator. Small and big companies use it to evaluate their actual financial performance.

With EVA, you can get to know where your company directs the invested funds of shareholders and find out whether a certain business can create shareholder wealth. It implies that a company should always make everything possible to enlarge shareholder’s value and be in demand. Simply put, EVA reflects the actual performance of a firm.

Besides depicting businesses’ financial performance, the measure encourages companies’ management to evaluate their assets and expenses during the decision-making process. However, the calculations of this indicator can be time-consuming.

EVA can be measured only for a particular timeframe, and it can’t determine the future performance of a particular company. Moreover, if a firm is in the middle of reorganization or considers making big investments of capital, it’s also challenging to obtain this measure.

Apart from reflecting on the performance of a company, EVA can help you find out even more essential facts about your business. In the next part, we’ll discuss the pros and cons of this calculation.

Advantages and Disadvantages of Economic Value Added

The value is common among entrepreneurs who need to see how their business performs with the invested capital and discover some related facts. This measure:

- serves as one of the methods to obtain financial data that aims at evaluating your business;

- shows how funds are managed;

- helps to reveal the working capital availability after the recoupment of its actual opportunity cost;

- is used by management to be aware of the company’s situation and check whether their firm performs successfully;

- indicates a connection between the use of capital and operating margin;

- helps see the opportunities your business has and make improvements to achieve them.

Economic value added is widely used by businesses as an evaluation tool. Nevertheless, you should also be aware of its disadvantages:

- it can’t help you define how effectively capital holders use retained profits through project management;

- it doesn’t consider the size of your business;

- it might overstress the need for businesses to generate results immediately;

- it can’t estimate the return on expenses.

This calculation is an essential step for any business. If you’ve decided to estimate EVA for your company, you will need to use a specific formula.

How to Calculate Economic Value Added

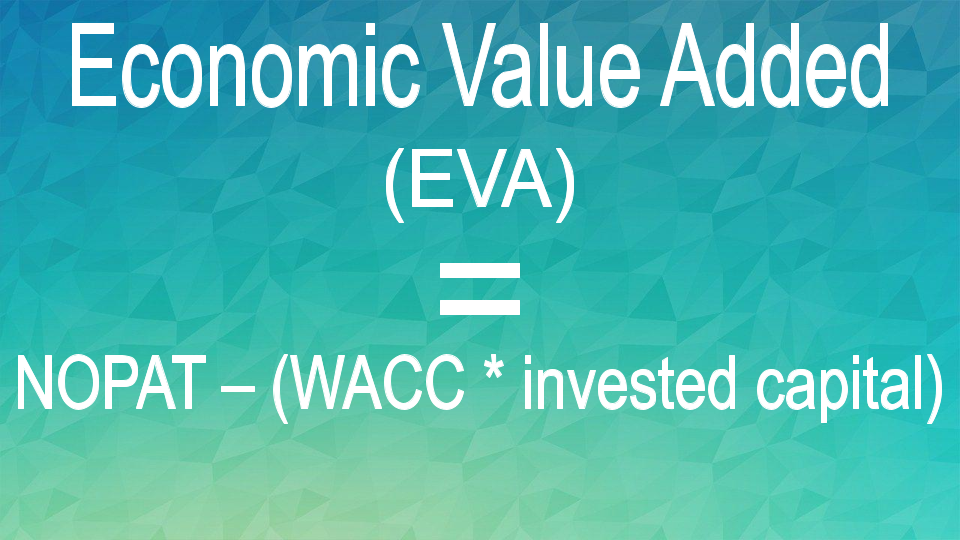

EVA is based on residual wealth. It can be estimated by deducting your company’s cost of capital from its profit. The formula was created to calculate the actual economic profit of a specific business.

Below you can see the formula with the help of which you can calculate your economic value added.

Where:

NOPAT = Net Operating Profits After Tax.

WACC = Weighted Average Cost of Capital.

Invested capital = Equity + Long-Term Debt at the Start of the Period.

Economic value added is based on the idea that a business brings profit when it creates additional wealth for the shareholders and leads to higher returns than the cost of capital.

Now that you know how to calculate this essential measure, it’s time to review several ways of increasing EVA for your brand.

How to Increase Economic Value Added

You can improve your EVA by increasing revenues or reducing capital expenses.

Increase profit

To increase revenue, you can consider well-known methods of raising the prices of your products or increasing the number of goods sold to your target audience.

If you decide to charge consumers more for your products, the profit margin will increase. Yet you can’t rule out the possibility that some of your clients will refuse to pay more for a product if you have not enhanced its quality, features, and benefits. In this case, there is a high probability of a decrease in demand and, as a result, a decrease in revenue. That’s why it’s advisable not to increase prices drastically.

It’s a known fact that you can also increase your revenues by selling more goods and services. To meet the demand, you need to produce a considerable number of products. Ensure that the manufacturing cost doesn’t exceed the revenue you can receive.

Simply put, if you want to improve your EVA by increasing the company’s profits, make sure that the marginal revenue is bigger than the marginal costs associated with the production. For example, there is no point in spending $200,000 on production to earn $150,000.

Reduce capital expenses

Operating expenses and marginal productivity influence your net capital costs. As an entrepreneur, you can decrease operating expenses by asking your creditor to revise the terms of the contract and the interest rate. Try to make the interest rate lower so that you can pay less money. Besides, negotiate a lower cost for the space you rent for your business purposes.

Reaching economies of scale empowers your company to improve marginal productivity. It will enable you to find ways to produce the same quantity of goods at a lower cost. For this purpose, consider creating a better production plan or using new technology.

EVA is a crucial measure that can show you the value your business generates. This, in turn, allows you to improve the generated profit by reducing capital expenses or increasing your revenue.

Resources:

- This article covers the definition, advantages, and disadvantages of economic value added.

- In this article, you can find out how to improve economic value added.

or